Indian equities are one of the brighter corners of sunshine in the global markets. The Nifty 50 has surged by 29%, the Nifty Midcap 100 by 60%, and the Nifty Smallcap by 70% over FY23-24. The standout performer, however, has been the BSE PSU Index, which soared by a staggering 92%, particularly noteworthy given its lacklustre performance over the past decade.

This robust equity market has spurred a wave of activity in the capital markets, with 57 initial public offerings (IPOs) raising a total of Rs 53,000 cr in 2023 alone. The momentum has continued into 2024, with 13 more IPOs already hitting the market. In total, 2024 could see 60+ companies hitting the market and are likely to raise upwards of Rs 70,000 cr.

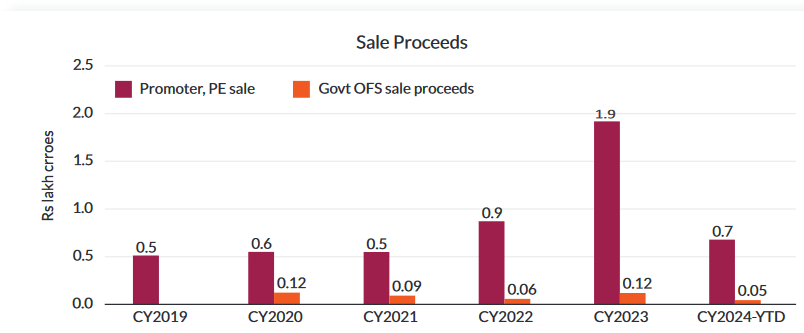

The secondary market has been even more active, with private equity firms and company promoters offloading nearly Rs 2 lakh cr worth of shares in 2023, 4x the average from 2019 to 2021. Even the parent companies of several multinational corporations operating in India, such as Whirlpool (24.7%), GMM Pfaudler (13.6%), and Timken (10% stake), have taken advantage of the favorable market conditions to reduce their stakes over the past year.

Between January and March 2024 so far, Rs 68,000 cr worth shares have been sold already.

This robust market environment presents a compelling opportunity for the government to strike while the iron is hot.

India’s divestment story

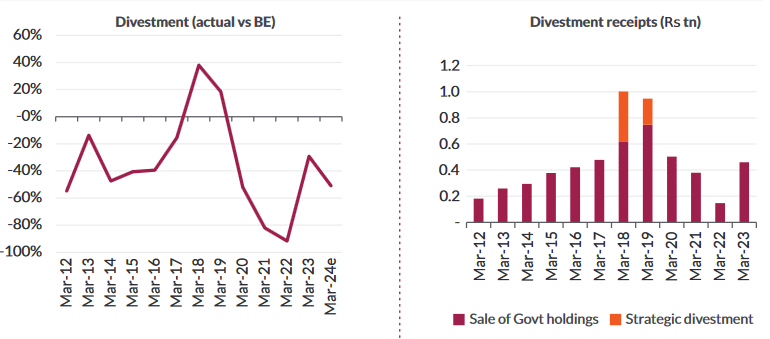

In recent years, the government has fallen short of its divestment target by 60%, with the highest being Rs 1 lakh cr in FY18, equivalent to 0.6% of GDP. However, the aggregate market capitalization of the 84 PSU entities has surged by 79% since early 2023, reaching Rs 67 trillion as of 23 February. In 36 of these firms, share prices have doubled since 2022, yet the government’s offers for sale have remained consistent at Rs 0.1 lakh cr annually.

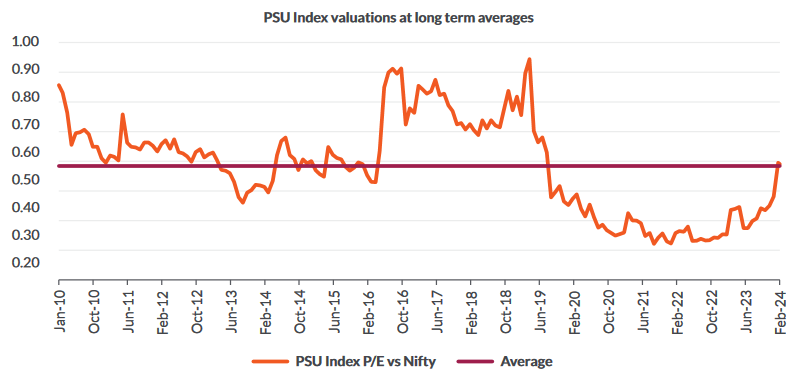

The PSU rerating isn’t without reason and the robust stock performance is underpinned by: (1) the strong financial resilience of traditional economy sectors during the COVID-19 pandemic, (2) government policies and reforms, such as defense indigenization, benefiting companies in these sectors, (3) a heightened focus on corporate governance, including formalized payout policies, balance sheet restructuring in public sector banks, and a structured divestment strategy, and (4) attractive valuations, with many firms reaching decade-low valuations and offering dividend yields surpassing those of debt instruments.

This vigorous performance has propelled the aggregate market capitalization of PSU stocks to Rs 67 trillion, accounting for approximately 17% of India’s total market capitalization, up from Rs 37 lakh at the beginning of 2023. Despite this sharp uptick, the valuation discount of the PSU Index relative to the Nifty has merely returned to its long-term averages.

Opportune time to raise growth capital: Credit growth in India typically needs to outpace GDP growth by 1.5x. To match this credit demand banks in India will continue to need growth capital. Our estimates suggest that PSU Banks may need approximately Rs 2 lakh cr of growth capital over the next five years to sustain current loan growth rates. Mr Market is now presenting a favorable opportunity for these banks to bolster their capital and meet their growth needs. This is evidenced by the successful capital raising efforts of several PSU banks in the public markets, which have strengthened their balance sheets in recent months.

While PSUs are often exempt from the minimum public shareholding norms applicable to other companies, the average government holding in PSUs remains high. In 22 of the 84 PSUs, the government owns more than 75% of the shareholding. This market upswing presents the government with an ideal opportunity to reduce its holdings. If the government were to reduce its holdings to 51% across companies, it could divest a quarter of its stake, potentially raising Rs 11 lakh cr in the process. A significant portion of this amount, one-fourth, would come from its holdings in the Life Insurance Corporation of India (LIC) alone.

By divesting in a staggered manner, reducing their holdings by 300 basis points each year, the government could generate over Rs 2 lakh cr (0.6% of GDP) in capital receipts. This would help bridge the fiscal deficit and reduce net market borrowing.

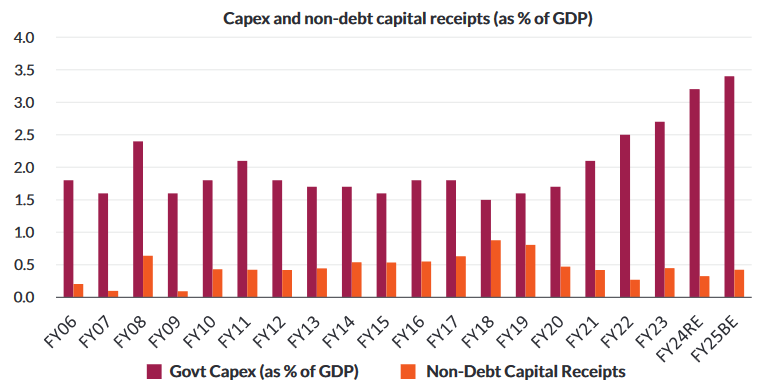

Step up in capital receipts can help in funding increasing capex

Over the past five years, one of the most notable successes in fiscal policy has been the 3.6x increase in capital expenditure, from 1.6% of GDP to 3.4%. To maintain this pace and sustain the move towards fiscal consolidation, it would be a natural next step to increase capital receipts through divestments.

A well-executed PSU divestment strategy could have far-reaching benefits for the Indian economy. It could attract foreign investment, raise corporate governance standards, and generate funds for further infrastructure development and social welfare programs, thereby enhancing the dynamism and competitiveness of the economy.

Source: India Budget, Bloomberg, Axis MF Research as on 31st March 2024

Disclaimer: This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

While utmost care has been exercised while preparing this document, Axis AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to र 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

Past performance may or may not be sustained in future.